In 2023, global spending on data centre systems reached US$236 billion, an increase of 4 per cent from 2022. This is forecast to grow a further 10 per cent in 2024.

Growth is driven by demand for services that power artificial intelligence (AI), cloud storage, streaming, the Internet of Things (IoT) and more. This global boom has created a data centre asset class that delivers, generally, a higher-than-average return for investors alongside long-term tenancies and a promising future forecast.

Our post-COVID world fuels remote working, cloud storage and system optimisation – further contributing factors to our rise in data centre investment.

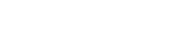

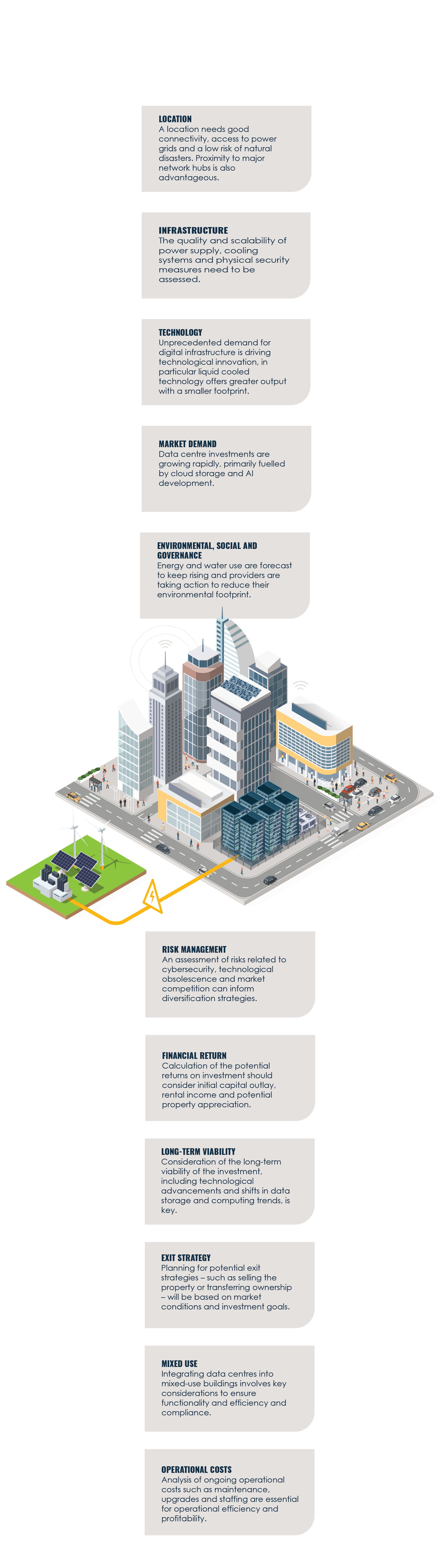

So, how should you approach a data centre investment? What red flags should you look for? In our experience, these focus areas help investors demystify a potential investment by uncovering the technical and commercial risks and opportunities for market differentiation.

Where to look for risk

Location

The total global electricity consumption of data centres could reach more than 1,000 TWh in 2026, up from 460 terawatt-hours (TWh) in 2022. This demand is roughly equivalent to the electricity consumption of Japan.

A data centre, therefore, needs good connectivity, access to power grids and renewable energies. Proximity to major network hubs and main fibre distribution corridors is also advantageous.

Ideally, it should also be located where there’s a low risk of natural disasters.

International data centre expansion is ramping up with substantial growth in South East Asia. While the lion’s share of data centres is in the USA, data centre providers and their clients will see more development outside traditional markets.

| Region | Transaction volume 2023 | Contributing factors | Challenges |

|---|---|---|---|

| North America | $4.8 billion |

|

|

| Asia Pacific | $1.1 billion |

|

|

| Latin America | $900 million |

|

|

| Europe | $600 million |

|

|

Infrastructure

The quality and scalability of a data centre’s infrastructure needs to be assessed, including power supply, cooling systems, water supply, physical and cyber security measures. These are questions for an investor to investigate:

- Do I have the power locked in?

- What’s the expected future capacity and is the location and power supply able to meet this? (Understanding the load profiles and expected uptake is crucial in site selection and subsequent power supply.)

- What power constraints are there?

- Can the current structural, electrical, mechanical and hydraulics infrastructure cope with an increased load? What constraints do they have?

Environmental, social and governance

Data centres could double their electricity use by 2026, according to a report by the International Energy Agency. By 2030, they’re forecast to consume 9 per cent of the grid’s demand in the United States, 8 per cent of the grid’s demand in Australia and 6 per cent of the grid in the United Kingdom.

Data centres in Ireland accounted for more than 21 per cent of metered electricity in 2023. The Dublin area is now subject to a de facto moratorium on new data centres.

They also use more than 4.3 trillion m3 of water globally each year, mainly for cooling and humidification. Both electricity and water use are expected to grow exponentially.

Naturally, investors are putting pressure on providers to reduce their environmental footprint.

Purchase power agreements (PPAs)

Many operators are matching their annual power consumption with zero-carbon renewable energy outputs and putting together green PPAs to support these. Offset arrangements like this are now becoming common place.

Green investments

Investors can look at their existing green investments, for example renewables, and use these to offset data centre usage. This is the green ying to the power consumption yang and has driven high demand for ‘greening assets’ such as forestry, wild lands and biodiversity.

Liquid cooling technology

Technology which uses less floor space than a traditional data centre can shine a positive light on the reduction of embodied carbon related to the supporting built form. Liquid cooling technology offers the same output with a much smaller floorplate.

Technology

The graphics processing unit (GPU) enables AI. It was designed, specifically, for the large amount of processing required to output high resolution images to a personal computer. The current generation is known as a central processing unit (CPU).

Early GPUs were capable of processing large amounts of information quickly, although they require exponentially large amounts of energy to enable high performance. Those GPUs are now used to support the extreme amounts of processing that is required to enable the AI engine.

With the unprecedented take up of AI and its demands for high frequency workloads, traditional air-cooled methods can no longer dissipate the heat generated by a GPU in a data centre. This is where liquid cooling comes in.

Liquid-cooled technology is 25 times more efficient than air-cooled technology.

Liquid cooling

There are 2 distinct options here – direct to chip (D2C) and immersion cooling. Both options offer a superior heat transfer medium than air cooling and are more efficient. Immersion has the added benefit of taking up 5 times less space than traditional air cooling while offering the same results.

Both technologies are in their infancy with D2C looking more feasible in the short term. This is because data centres currently in operation lend themselves better to installing D2C within their existing footprint, allowing for a blended environment where not all equipment is liquid cooled.

A new data centre suits immersion as it can be designed to be more efficient and have a much smaller footprint.

Obsolescence

Investors also need to be aware of creeping obsolescence with technology that may become redundant within the asset’s lifecycle. Alongside this, there may be space constraints when updating technology.

Liquid cooling technology can enable higher rack loads and greater return on investment.

Mixed-use buildings

Integrating data centres into mixed-use buildings involves key considerations to ensure functionality, efficiency and compliance. There is also potential for the reuse of heat rejected by the data centre. In order to assess the suitability for a data centre in a mixed-use environment, a number of elements need to be considered.

Structural integrity

The building structure needs to:

- support the weight of equipment

- accommodate any special requirements for floor loading and vibration isolation to protect sensitive equipment.

Security

Stringent security measures need to be implemented to protect data and equipment from physical and cyber threats. This includes controlled access, surveillance systems and secure pathways for cabling.

Integration with building services

Data centre infrastructure should be coordinated with the building’s overall design, including electrical, mechanical and plumbing systems.

Accessibility and maintenance

Design should consider easy access for equipment installation, maintenance and upgrades. There needs to be sufficient service entrances and pathways for large-scale equipment.

Future scalability

Every data centre needs to plan for future growth and scalability within the building, considering both the physical space and infrastructure requirements.

Regulatory compliance

It’s critical to understand local regulations and compliance requirements related to data security, fire safety, electrical codes environmental standards and zoning laws.

There’s no existing standardisation across the market, making choices of cabling and connectors up to an individual provider. Investors should be educated and informed about best practices.

In some cases, data associated with the local population needs to stay onshore, including any back up data storage.

Cybersecurity

An assessment of risks related to cybersecurity can help organisations protect themselves against cyber threats. The Essential Eight, developed by the Australian Signals Directorate, recommends eight essential mitigation strategies as a baseline to protect against cyber threats. These processes and procedures should be implemented and maintained at all times.

Financial return

Generally, the equity returns for investors in data centres have been superior to traditional infrastructure asset classes, for example public private partnerships (PPPs). Experience has also shown data centres to be fairly liquid in terms of buying and selling operating assets.

They also tend to have a shorter economic life than other traditional infrastructure assets so have access to deeper pools of short-dated, and cheaper, debt.

Balancing capital and operational expenditure

An analysis of capital expenditure and operational costs should ensure ongoing budget is accurate and adequate. This should include maintenance, upgrades and staffing impacts.

Generally, capital expenditure and ongoing costs sit at a 20/80 ratio with 20 per cent up-front capital costs and 80 per cent operational costs. It’s critical to get systems and equipment finely tuned to keep operational costs in check.

Long-term viability

Consideration of the long-term viability of the investment, including technological advancements and shifts in data storage and computing trends, is key.

Exit strategy

Investors very often have an exit strategy in place when they initially acquire a data centre. Independent advisers will help fine-tune the exit strategy during the period of investment and aim to have a full vendor due diligence package available for when the investors chose to recycle their capital.

Understand a data centre’s entire lifecycle

A solid data centre investment is a multifaceted equation of location, infrastructure, power, technology, sustainability and more. Getting familiar with the unique – and fast moving – nature of the market is a good place to start.

The team you bring on board to advise on your investment needs to be able to identify risk and plan and design accordingly. It’s also wise to choose a team that understands all facets of a data centre investment – from defining a successful project to designing practical solutions, guiding successful delivery to recycling at end of life.

‘N2’ redundancy, ensuring there’s no single point of failure in the system.

RPS was engaged by the Bank of South Pacific to oversee the development of two business critical data infrastructure facilities featuring ‘N2’ redundancy, to ensure there could be no single point of failure in the system. Together, these projects were worth around 170 million PGK, $85 million AUD or £44 million GBP.

READ MORE>>

Better together

This article draws on the combined expertise of both NDY and RPS in the mission critical sector through the whole asset lifecycle.

Our experienced global advisors help you navigate the data centre market to make informed and sustainable investment decisions. As part of Tetra Tech, we bring the very latest insights in technology and sustainable leadership to help you invest wisely and mitigate risk.