THE FIRST MANDATORY SUSTAINABILITY AND CLIMATE REPORTS HAVE BEEN ISSUED

New climate disclosure requirements are coming into effect in various countries, supporting the allocation of capital in a way that facilitates the transition to a low-emissions, climate-resilient future.

They recognise the threat posed by climate change to the resilience of organisations and the need to provide financial lenders with comparable, reliable and consistent information so they can make informed investment decisions.

New Zealand and Australian legislation broadly aligns with the International Sustainability Standard Board’s (ISSB) S1 (General Requirements for Disclosure of Sustainability-related Financial Information) and S2 (Climate-related Disclosures), released in 2023. They apply a phased approach, with the largest entities reporting first, from 31 March 2024 in New Zealand and, likely, 31 December 2025 in Australia.

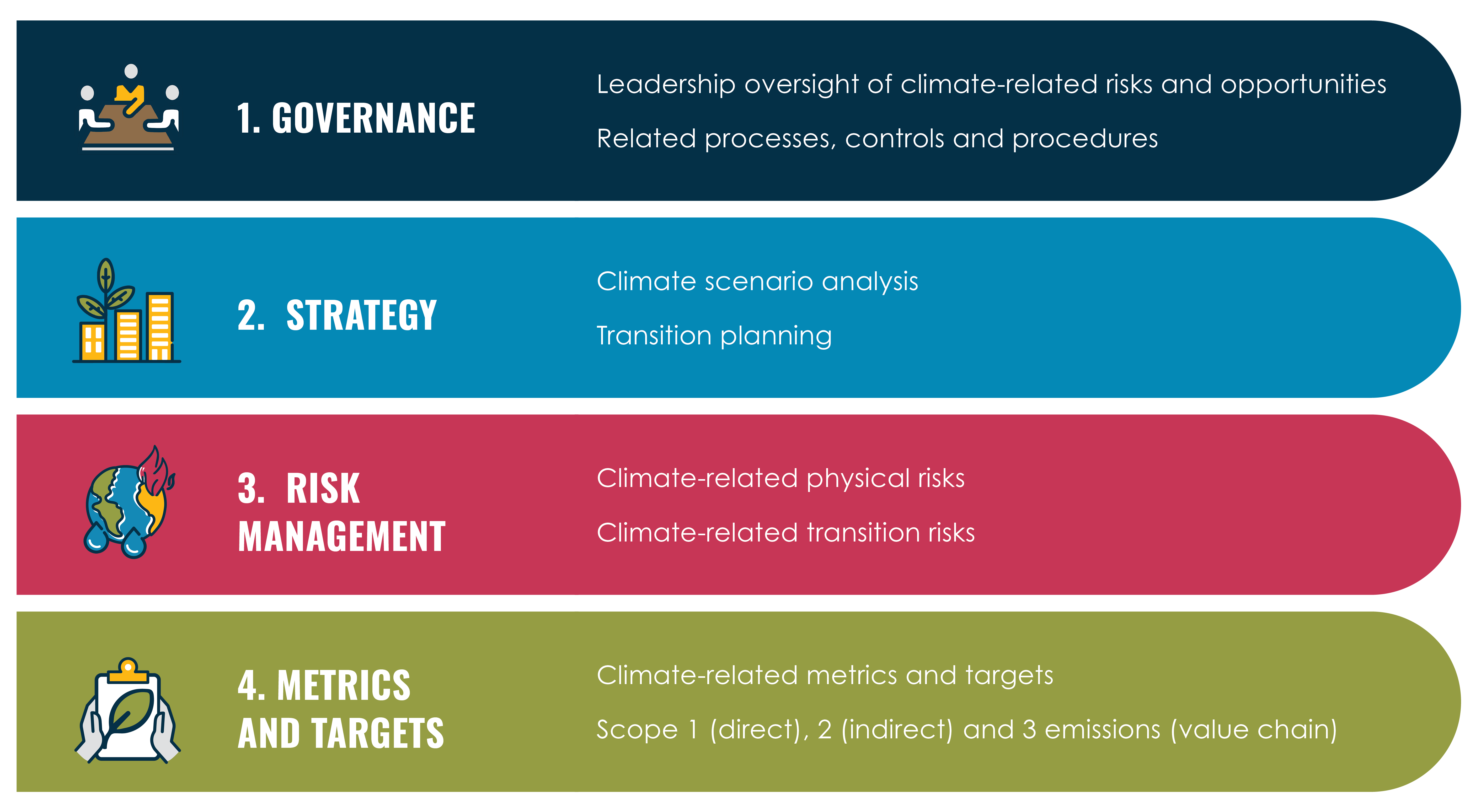

While compliance should be straightforward for entities used to reporting under the voluntary Task Force on Climate-Related Financial Disclosures (TCFD), as it includes the same key elements, others will need to invest considerable resources to get up to speed.

Evolution of climate reporting standards

REPORTING MAKES SENSE (& CENTS)

When companies move beyond just quantifying emissions and setting targets, they gain a deep understanding of the risks that climate change poses to their business.

This provides opportunities to avoid major issues, such as assets becoming devalued, and seize significant benefits, such as lower operational costs and increased asset value.

While disclosing information on climate-related risks and opportunities will only be mandatory for larger public and private entities in the near future, smaller organisations that take this step can realise benefits from voluntarily disclosing their approach to managing climate risks.

What is climate risk and why does it matter?

Real estate assets face significant risks from climate change which could lead to losses or stranded assets if managed poorly.

Key elements of climate-related disclosure requirements

How to get started

Tips on how property asset companies can best adapt to new reporting requirements, shared by representatives from Westpac NZ, Precinct Properties, New Zealand Green Building Council (NZGBC) and GRESB.

- Engage broadly across your organisation to bring the Board, risk, legal, finance and others up to speed on what these new requirements mean for your business.

- Reframe your climate change budgeting as an ‘investment’ rather than a cost. Set an internal price on carbon to help with the transition.

- Go deep (with scenario analysis) to understand the full risks of climate change and uncover the real opportunities for your business.

- Baseline your portfolio’s greenhouse gas (GHG) emissions, develop a net zero strategy and transition your real estate assets from brown to green.

- Leverage useful tools like GRESB and Climate Scenarios for the Construction and the Property Sector.